Durango Real Estate Comparative Statistics 2018-2019 Full Year

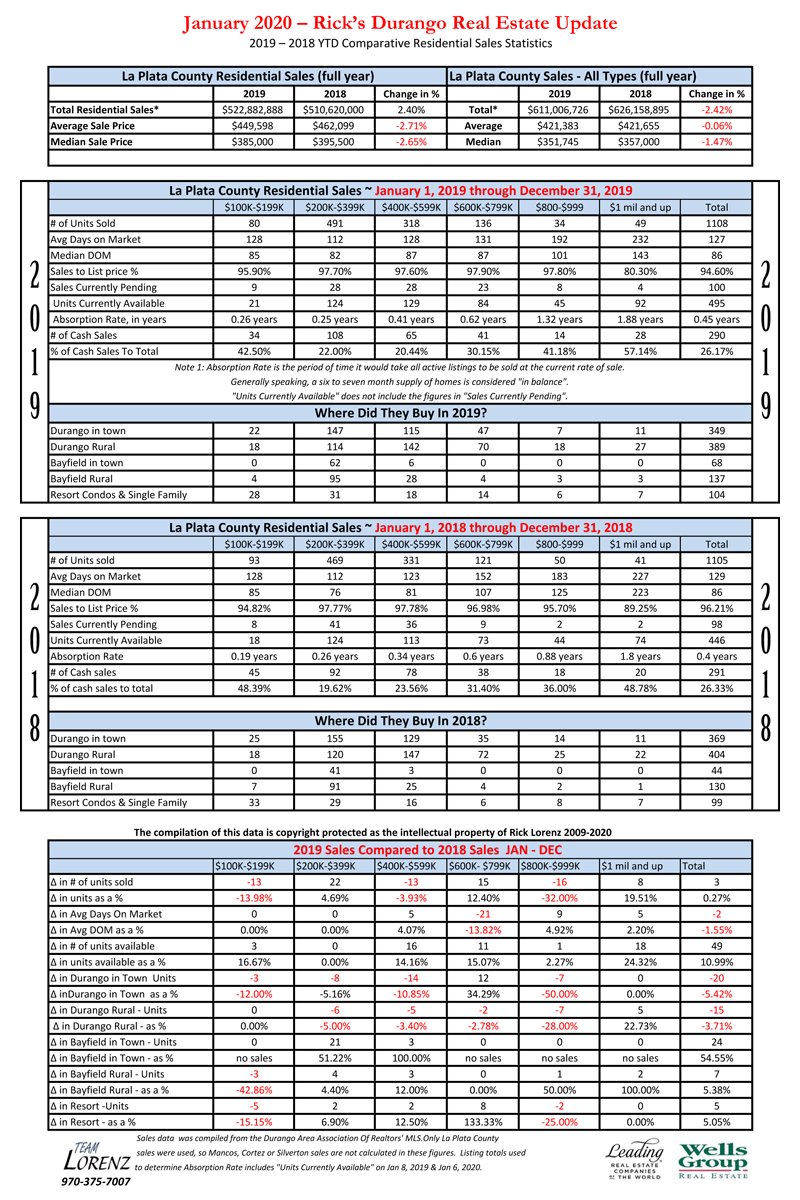

2019 saw a very slight increase (2.4%) in the total dollar volume of residential sales in La Plata County. The number of units sold essentially stayed the same with 1,105 units sold in 2018 and 1108 units sold in 2019. The interesting number is the decline in total dollar volume for “all types of sales” which would be residential, vacant land, farm and ranch, and commercial. That dollar volume dropped by 2.42%. On the residential side, both average sales price and median sales price dropped this year at approximately 2.65% each. The single largest decline came in the $800,000 – $1 million price range where there were 16 fewer homes sold this year than last, which represents a decline of 32%. Average and median days on the market this year compared to last year are essentially unchanged, but one thing that kind of stuck out to me was the “Sales to List Price Percentage” for 2019. The four main price categories from $200,000 up to $1 million all sold at over 97% of their asking price. For a long time, you have heard me harp about low availability of inventory. The year started with 446 units available and ended with 495 units available. We are slowly building up inventory which is good for buyers wanting to have a decent amount of product to compare so they can make a good choice.

One encouraging statistic was the increase in the number of sales for Bayfield. In 2018 there were a total of 177 sales (in-town and rural combined) and in 2019 that number jumped to 205 sales. Almost all of that increase came in Bayfield in- town sales between $200,000 – $400,000, which was certainly encouraging. An interesting number that I gleaned from all the statistics was the fact that the 2019 Durango in-town plus Durango rural sales totaled 738 units but in 2018 it was 773 units which is a drop of roughly 5%. Absorption rate and days on the market (both average and median) seem to be in line and are nothing alarming.

Where do I think we are going? Right now, I don’t see any reason for any big blips in the market. I think number of sales will probably stay pretty consistent with the last couple of years. Even though interest rates are predicted to stay low, there isn’t a lot of low-priced inventory which is the most sensitive to lower interest rates.